Dogecoin, known as DOGE, is a cryptocurrency that started as a fun meme but has now become a significant digital asset worldwide. For Indian investors, understanding DOGE INR trading is crucial because it involves not only cryptocurrency fundamentals but also India-specific regulations, exchanges, and taxation policies.offers a detailed look at Dogecoin in India, explaining how it works, the risks, storage options, trading platforms, and future prospects—all tailored for Indian users.

Understanding Dogecoin: Beyond the Meme

Dogecoin may have begun as a humorous internet meme, but it has grown into a major player in the crypto world. Unlike Bitcoin, Dogecoin emphasizes accessibility, fast transactions, and a vibrant community. For Indian investors, understanding the origins and functionality of Dogecoin is essential before investing in DOGE INR.Dogecoin is not just a joke coin. Its underlying technology, strong community, and widespread use cases make it an intriguing choice for crypto enthusiasts. While its supply is unlimited, Dogecoin has consistently shown real-world utility, from tipping creators online to charitable initiatives. Understanding its history and mechanics provides a solid foundation for navigating DOGE INR trading.

Origins of Dogecoin

- Created in 2013 by Billy Markus and Jackson Palmer.

- Inspired by the “Doge” meme featuring a Shiba Inu dog.

- Initially intended as a lighthearted alternative to Bitcoin.

- Built using a Scrypt-based proof-of-work, similar to Litecoin.

- Focused on small, everyday transactions rather than high-value trading.

Dogecoin Community and Culture

- Known for charitable contributions and social initiatives.

- Famous campaigns include supporting the Jamaican bobsled team (2014).

- Elon Musk’s endorsements boosted mainstream popularity.

- The community emphasizes fun, inclusivity, and innovation.

- Community-driven movements influence DOGE price and adoption.

Dogecoin vs Bitcoin

- Dogecoin has faster block times (~1 minute vs 10 minutes).

- Infinite supply vs Bitcoin’s capped 21 million coins.

- Lower transaction fees make it suitable for micro-transactions.

- Less focus on scarcity; more on community engagement.

- Price volatility is influenced by social trends, not just market fundamentals.

The Regulatory Landscape for Crypto in India

Investing in DOGE INR requires awareness of India’s evolving crypto regulations. While crypto ownership is legal, the government imposes taxes and guidelines to monitor and control trading activity.India has taken a cautious approach to cryptocurrency. While there’s no outright ban, regulatory clarity is still evolving. Indian investors must understand tax implications, transaction reporting, and compliance requirements before trading DOGE INR. This knowledge ensures safe and legal trading.

Historical Regulatory Background

- 2018: RBI restricted banks from dealing with crypto firms.

- 2020: Supreme Court overturned the RBI ban.

- Post-2020: India adopts a “tax and regulate” approach.

- Ongoing debates about classifying crypto as currency or asset.

- Regulatory environment remains dynamic, requiring vigilance.

Taxation and Compliance

- Flat 30% tax on all crypto gains.

- 1% TDS on transactions exceeding ₹10,000 annually for general users.

- Record-keeping of all DOGE INR transactions is mandatory.

- Exchanges often deduct TDS at source and report to authorities.

- Understanding taxes ensures compliance and prevents penalties.

DOGE INR Trading: Platforms and Mechanisms

Trading DOGE INR is simple once you know the right exchanges, deposit methods, and trading mechanics. Indian exchanges provide a user-friendly way to buy, sell, and store Dogecoin.Several Indian crypto exchanges facilitate DOGE INR trading with local payment methods. Investors can trade directly in INR, making it easier than using foreign currencies. Security, liquidity, and convenience are the main factors to consider when selecting a platform.

Popular Exchanges in India

- WazirX – Leading platform with UPI and IMPS/NEFT support.

- CoinDCX – Beginner-friendly with multiple deposit options.

- ZebPay – One of the oldest exchanges with reliable services.

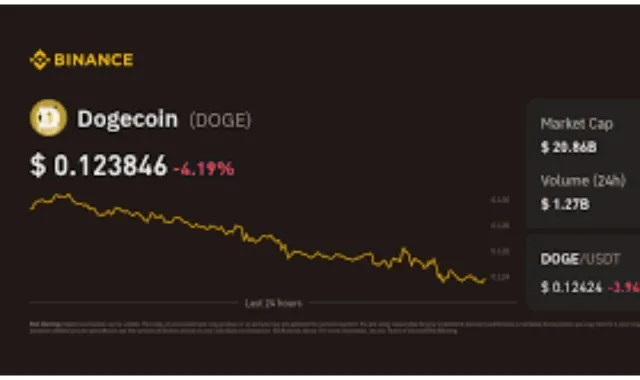

- Binance (P2P) – Offers global liquidity via peer-to-peer transfers.

- LocalBitcoins/Other P2P platforms – Flexible but require caution.

How to Trade DOGE INR

- Register on a trusted Indian exchange.

- Complete KYC verification.

- Deposit INR using UPI, NEFT, IMPS, or bank transfer.

- Place a market or limit order to buy Dogecoin.

- Store securely in a wallet or leave on the exchange for short-term trading.

Exchange Comparison Table

| Platform | DOGE/INR Availability | Deposit Methods (INR) | Withdrawal Fees | Key Features for Indian Users |

| WazirX | Yes | UPI, Bank Transfer (IMPS/NEFT) | Varies | India’s leading crypto exchange |

| CoinDCX | Yes | UPI, IMPS, Payment Gateway | Varies | User-friendly interface for beginners |

| Binance (P2P) | Yes | P2P bank transfer/UPI | Varies | Global liquidity and high volume |

| ZebPay | Yes | Bank Transfer, UPI | Varies | One of India’s oldest exchanges |

Risks and Volatility in the Indian Context

DOGE INR trading is exciting but comes with high volatility. Investors need to understand both cryptocurrency risks and India-specific financial risks.Dogecoin prices fluctuate dramatically due to social media trends, celebrity endorsements, and market sentiment. Indian investors face additional risks related to currency conversion, taxation, and regulatory uncertainty. Recognizing these risks is crucial for safe trading.

Price Volatility

- Highly sensitive to Elon Musk and other influencer tweets.

- Short-term price spikes and crashes are common.

- Not backed by tangible assets; speculative nature increases risk.

- INR exchange rate fluctuations can amplify losses or gains.

- Avoid panic trading during volatile periods.

Regulatory and Tax Risks

- Sudden changes in Indian crypto laws can impact trading.

- 30% flat tax reduces net gains significantly.

- 1% TDS reduces liquidity on every major transaction.

- Exchanges could face regulatory shutdowns unexpectedly.

- Keeping thorough records ensures compliance.

Security Risks

- Exchanges are susceptible to hacking attacks.

- Hot wallets are convenient but vulnerable.

- Cold wallets provide maximum security for long-term holdings.

- Use strong passwords and 2FA on all accounts.

- Avoid storing large amounts of DOGE INR on exchanges.

Storing Your Dogecoin Safely in India

Security is a top priority for DOGE INR investors. The choice of wallet depends on trading frequency, convenience, and risk tolerance.While exchanges are convenient, they carry counterparty risk. Using wallets—hot or cold—ensures your Dogecoin is safe from cyber threats. Understanding wallet types is essential for all Indian crypto investors.

Hot Wallets

- Mobile or desktop-based software wallets.

- Convenient for regular trading or small transactions.

- Examples: Trust Wallet, Dogecoin Core Wallet.

- Internet-connected; vulnerable to phishing or malware.

- Recommended only for short-term holding.

Cold Wallets

- Offline storage devices like Ledger and Trezor.

- Highest level of security for long-term investors.

- Resistant to online hacks or exchange failures.

- Suitable for hodling large amounts of DOGE INR.

- Must keep backup and recovery phrases secure.

Future Outlook for DOGE INR in India

The future of DOGE INR depends on regulatory clarity, global adoption, and technological innovations. Investors must stay informed to make strategic decisions.Dogecoin’s popularity in India is growing, but long-term prospects rely on government policies and market dynamics. As crypto adoption rises globally, DOGE could see broader utility and acceptance in India, offering exciting opportunities for tech-savvy investors.

Potential Growth Factors

- Increasing crypto adoption among Indian millennials.

- Corporate and institutional interest could boost liquidity.

- Government clarity may encourage mainstream investment.

- International use cases and partnerships can influence price.

- Community-led campaigns continue to drive engagement.

Challenges Ahead

- Regulatory ambiguity remains a concern.

- Price manipulation and speculative trading could deter new investors.

- High taxation (30%) may reduce profitability.

- Competition from other meme coins and cryptocurrencies.

- Maintaining security remains a continuous challenge.

FAQs

Is it legal to own and trade Dogecoin in India?

Yes. Owning and trading Dogecoin is legal in India. All profits are subject to a 30% tax, and 1% TDS applies to transactions exceeding ₹10,000 annually.

Which exchanges support DOGE/INR trading pairs?

Major Indian exchanges like WazirX, CoinDCX, ZebPay, and Binance (P2P) support direct DOGE/INR trading pairs, enabling users to trade with INR directly.

Do I need to pay tax if I make a small profit?

Yes, the 30% crypto tax applies to all gains, regardless of amount. There are no exemptions for small profits.

How does the 1% TDS work?

Exchanges deduct 1% TDS at the time of qualifying transactions and remit it to the Income Tax Department on your behalf.

Can I use UPI to buy Dogecoin in India?

Yes, most reputable Indian exchanges support UPI for deposits, enabling instant transfers for trading DOGE INR.

Is Dogecoin a good investment for average Indian citizens?

Dogecoin is highly speculative and volatile. Investors should only use funds they can afford to lose and conduct thorough research.

How can I secure my Dogecoin holdings?

Use a cold wallet like Ledger or Trezor for long-term storage. Hot wallets are better suited for small, frequent transactions.

Can Dogecoin be used for payments in India?

While some platforms accept Dogecoin for payments, its mainstream adoption as a currency remains limited. Most users treat it as an investment.

What factors affect DOGE INR price?

Social media sentiment, celebrity endorsements, market speculation, and INR exchange rates all influence Dogecoin’s price in India.

Should I trade DOGE INR on international exchanges?

International exchanges offer high liquidity but may have stricter KYC and withdrawal limits for Indian users. Domestic exchanges are more convenient for INR deposits.

Conclusion

Dogecoin offers Indian investors an engaging entry into cryptocurrency. Understanding DOGE INR trading, taxation, platform selection, and secure storage is crucial. By staying informed and cautious, Indian users can navigate the volatile but fascinating world of Dogecoin successfully.